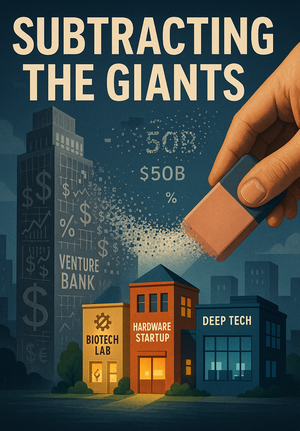

The modern venture capital ecosystem has undergone a fundamental transformation that most market observers have failed to properly diagnose. The largest venture firms—Andreessen Horowitz, General Catalyst, Thrive Capital, and others—have evolved beyond their early-stage venture roots into something entirely different: Venture Banks - multi-billion dollar asset managers operating across growth, debt, and private equity-style vehicles.

We continue to include these firms in the same datasets that define the "venture capital market." This categorical error massively distorts our understanding of innovation funding—and the data proves it.