Carta's Charts Don't Lie: The Series A Sprint Is a Cartel-Designed Death Trap

members

–

6 min read

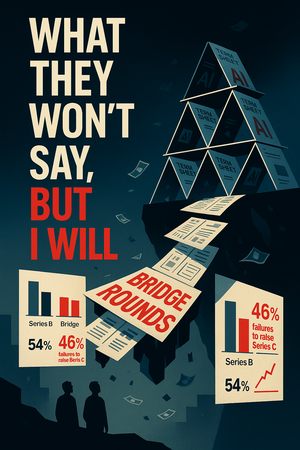

Peter Walker's latest Carta data reveals a brutal truth: if your startup hasn't raised Series A within 24 months of seed funding, you're essentially dead.